In 1960, 17 African countries achieved formal independence, in what is known as the “Year of Africa”. Of these 17, 14 were French colonies, and while France would still maintain some colonial outposts for years after (some even until today) the Year of Africa was also the death of the French colonial empire.

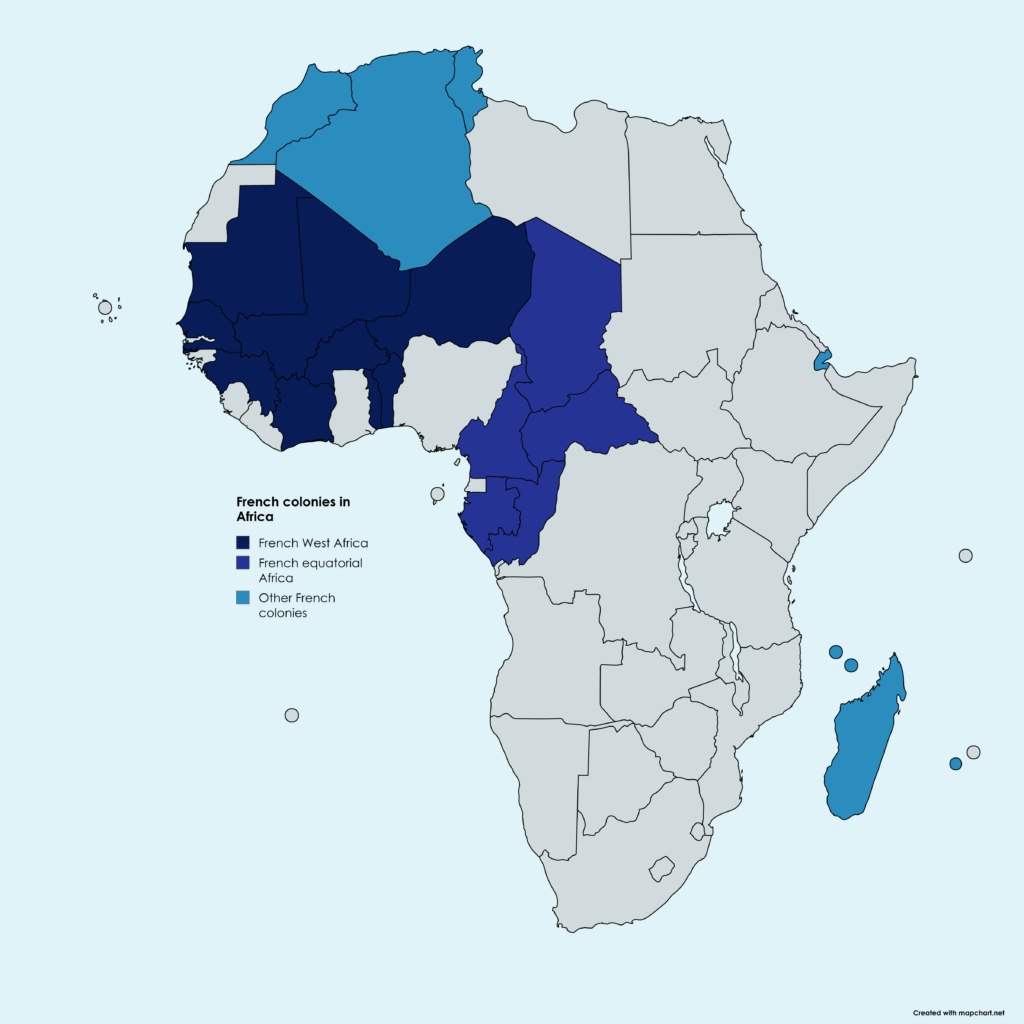

Since then, France has had an outsized influence in their former colonies, especially those in what used to be the two French colonial federations of French West Africa and French Equatorial Africa. This neocolonial relationship has been an important factor in both French and African politics since the 1960s, and the region most influenced is called the “Françafrique”, the French sphere of influence in Africa.

Map of French colonies in Africa. The focus here will be on the old West Africa and Equatorial Africa regions.

This is the first article in a coming series about the Françafrique’s past, death and future legacy. This article will be about the economic aspects of the Françafrique, covering trade, aid and monetary policy. Articles concerning military operations and pullouts, the Saharan Jihad, the coup belt, Russia’s role, the future of the Françafrique and more will be released throughout the summer.

The CFA Franc

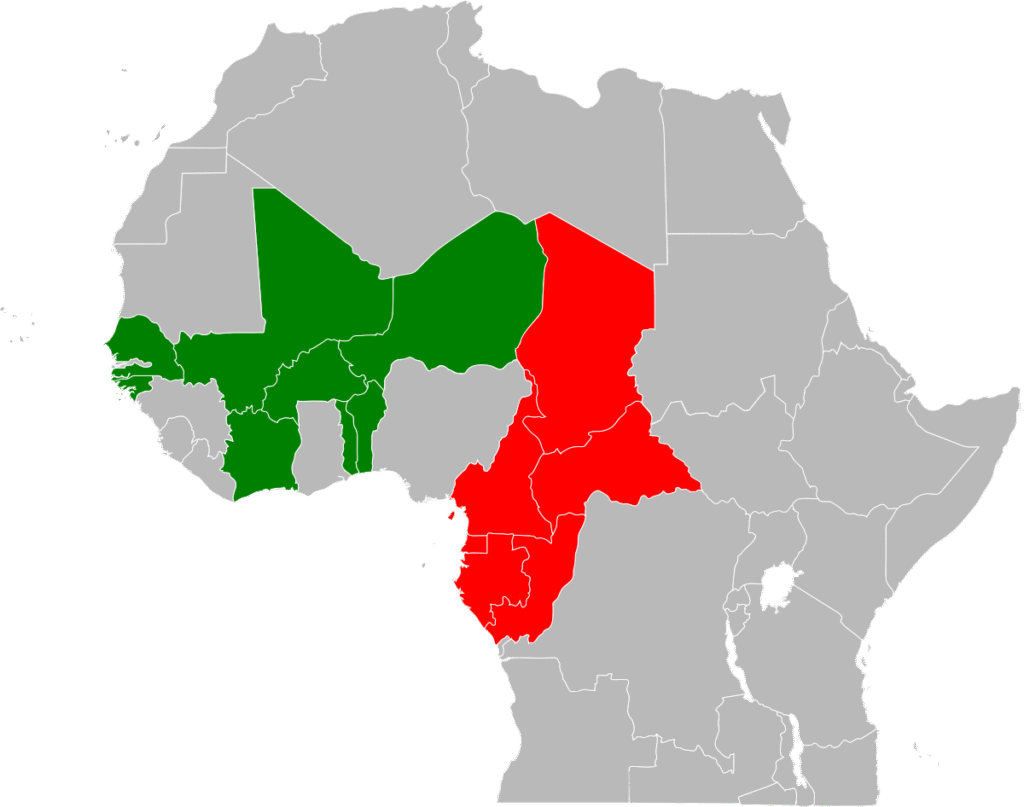

French economic influence in the West and Central African regions is maintained by two separate monetary unions, the two CFA franc zones. The CFA Franc is two separate currencies, one for Central Africa and one for West Africa, used by 14 countries in total.[1] Their values are equal, pegged to the Euro, and managed by the French central bank. Both zones used to have a rule that 50% of all foreign exchange reserves in the French treasury. This was repealed in West African Franc zone in 2020, but remains the case in Central Africa.

The West African and Central African monetary zones. Note the similarity with the old colonial federations.

The reason for the reform to the franc happening in West Africa and not Central Africa is that the Economic Community of West African States (ECOWAS) was planning to transform the West African franc into a new currency, the Eco. The Eco would then be used as a currency by the entirety of ECOWAS, including those countries that do not currently use the Franc.[2] The Eco project is not cancelled, but has seen little progress since 2019.

The two African francs are the only currencies in the world that are issued to sovereign nations by another country that does not use the currency itself. That means that France is in a unique position to remotely control the monetary policy of other countries without its own economy being affected, which is a uniquely powerful position of leverage.

This arrangement of France providing monetary stability without any direct gain for itself can be understood as either generous or cynical. The official French position is that the Franc zones are maintained to help the countries that use the currencies. Critics of the currency union, on the other hand, usually see it as a French plot to keep countries dependent on French goodwill.

A 1000 Central African Franc bank note. With current standardized evaluation, this bill is worth 1.52 Euros.

The coup leaders in Niger, Mali and Burkina Faso have criticized the franc, but in breaking with ECOWAS they have also sabotaged the effort of making the Eco into a viable alternative. The situation allows French diplomats to pay lip service to the Eco, while the coup governments keep using the Franc to avoid a crisis in their already unstable economies.

The efficacy of the CFA Franc in actually helping the economies that use it is disputed. Over the long term the currency union has supported the countries subject to it by keeping inflation low and the economy stable. On the other hand, the act of devaluation being controlled by France has both restricted the countries’ abilities to respond to challenges and, in some other cases, devaluation has come at a very unfortunate time.[3]

FDIs and aid

Aside from France’s remote monetary policy, the West African region in particular is linked to France through Foreign Direct Investment (FDI) and developmental aid. Nigeria is the main recipient of French FDI, but is also the largest economy in Africa.[4] French investments in Nigeria shows an interest in building up French influence and relations outside of the strict borders of the Franc zones.

French FDIs and aid do help the recipient countries with development, but also gives France another method of leverage over the recipients. Following the coups in the Sahel, France blocked aid and budgetary support to the couped countries, which makes the transition away from France harder and the prospect of another country to also leave the French orbit less attractive.

Development aid and investment has a benefit apart from just ensuring loyalty, which is that the allies of France are more useful. Allied countries that are capable of producing value are more interesting trading partners, and allies that are capable of maintaining their own security are less likely to need costly and controversial military interventions.

Trade

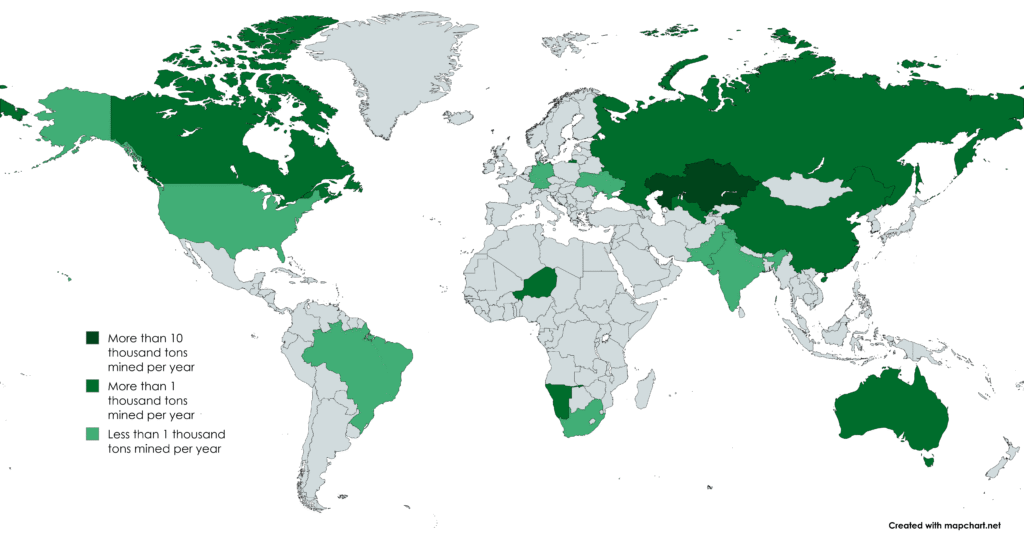

French trade in Africa is one reason that the maintenance of French influence has been seen as so important. Niger has a particular role in this, as Nigerien mining has provided France with a large proportion of the uranium needed to run French nuclear power plants. The French state-owned mining firm Orano used to run uranium mining in Niger until the events following Niger’s 2023 coup.[5]

Global uranium production by country. Niger is the West African producer. While Australia and Canada are friendly to France, French policymakers have been traditionally suspicious of the USA, which wields far more influence in those two countries.

The ability for France to source its uranium from a country that is dependent on France has supported France’s position as an independent great power. Major uranium-producing countries are few and far between, and the other available uranium exporters for France are closer to other great powers that may block French access in a crucial moment. In that regard, Niger is the main French strategic benefit of the Françafrique, and may explain why only the coup in Niger caused a Nigerian war scare, while the coups in Burkina Faso and Mali did not.

While the case of Niger is about uranium, French search for influence in Africa cannot be explained by resource concerns alone. French economic and political influence in Central Africa has little to do with Nigerien politics, and shows that France has ambitions beyond what is strictly a strategic necessity. The economic policy of the Françafrique is intertwined with French political and military plans, and is the clearest expression of France’s great power status outside of Europe.

Sources

[1] https://publications.banque-france.fr/sites/default/files/medias/documents/816153_fiche_zone-franc.pdf

There are technically three zones with the Comoros making up the third, but it is valued differently from the other two.

[2] https://finance.gov.ng/ecowas-powers-ahead-with-single-currency-launch-by-2027/

[3] https://www.brookings.edu/articles/how-the-france-backed-african-cfa-franc-works-as-an-enabler-and-barrier-to-development/

[4] https://www.diplomatie.gouv.fr/en/country-files/nigeria/france-and-nigeria-65149/

[5] https://www.reuters.com/markets/commodities/frances-orano-says-it-has-lost-control-uranium-mine-niger-2024-12-04/

Leave a Reply